_1765421594952.jpg)

As the calendar turns toward 2026, the research industry is stepping into unfamiliar territory. What once felt like distant possibilities. AI-assisted sampling, modular surveys, global panels and data-privacy compliance have become everyday concerns. For many teams, the challenge is no longer whether to adopt these tools and methods, but how quickly and safely they can be deployed while keeping data quality intact.

This article reviews the structural shifts of 2025 and sketches what those shifts mean for research operations in 2026 - from AI-powered workflows to shorter, more modular fieldwork, from globalized panel infrastructure to stricter compliance demands. The goal is to provide a compass for research professionals and agencies preparing for the next phase.

What Changed in 2025: Structural Shifts, Not Just Trends

AI Began to Reshape the Industry’s Core Workflow

In early 2025, several industry reports showed AI evolving beyond experimentation, becoming core infrastructure for research teams. According to one recent article on market research methods, a growing proportion of research professionals now integrate AI into routine tasks such as survey design, data cleaning, and analysis.

The implications are profound. Where once building a panel, cleaning data, checking for fraudulent responses, and generating reports required weeks or months, many of those steps can now be accelerated through AI. Suddenly, timelines shrink, but so does the margin for error. For teams that rush to adopt new tools without updating quality control standards, risk of bias, fraud, or poor data integrity has increased.

Privacy & Compliance Became Non-Negotiable

Also in 2025, regulatory scrutiny tightened. In response to growing worries around data use, several research-industry associations revised their standards. For example, global bodies updating codes of practice emphasized transparency, consent, data handling, and ethical research when synthetic data or AI-assisted tools are used.

For research providers and panel teams, this meant shifting from optional compliance practices to building audit-ready processes. It also meant that transparent documentation, consent-first methods, and participant safeguarding would become key differentiators for long-term sustainability.

Key Challenges That Emerged

2025 exposed several stress points for agencies and research teams, and these are likely to intensify in 2026.

First, data quality under pressure. As budgets tighten and incentives rise, many teams struggled with increased drop-outs, inattentive responses, or straightlining. Relying solely on AI-driven fraud detection proved insufficient. Without a layered quality-control framework, speed gains risked being offset by poor reliability.

Second, information overload. AI made it easier than ever to churn out reports, dashboards, and analyses. But buyers and decision-makers often found themselves overwhelmed with “insights” and underwhelmed by actionable takeaways. The proliferation of output did not guarantee clarity or utility.

Third, global + local complexity. For teams operating across regions, the demands piled up: multi-language surveys, local compliance requirements, cultural adaptation, and fast turnaround. The days of one-size-fits-all panels are fading.

These challenges underscored a truth: technology alone can’t solve everything. Methodology, attention to human behavior, compliance, and strategic thinking still matter. Perhaps now, more than ever.

What Will Define 2026: Emerging Industry Trends

AI-Enabled “Quality-First” Research Will Become Standard

In 2026, the industry’s winners will be those who don’t just chase speed, but use AI to boost quality and reliability. Expect to see wider adoption of AI-assisted respondent validation, behavioral scoring, consistency checks, and enhanced fraud detection. Instead of seeing AI purely as a cost-saver, top teams will treat it as a quality assurance lever, combining algorithmic speed with human oversight.

Modular, Short, Mobile-First Surveys Will Supersede Long Trackers

With declining respondent tolerance for long surveys and rising survey fatigue, research will shift toward shorter, more frequent, and mobile-optimized instruments. Quick polls, message-testing pulses, and split-exposure tests will replace some traditional large-scale trackers. This agility enables brands and agencies to react to market changes in near real-time.

Micro-Panels and Niche Communities Will Gain Importance

Large, general-population panels are giving way to micro-communities, specialized, high-engagement groups built around interests, demographics, or behavioral traits. These panels may offer lower volume but higher quality, better engagement, and more actionable insights, especially useful for niche products, subcultures, or hard-to-reach demographics.

Global, Cross-Market & Multi-Language Infrastructure Becomes a Must-Have

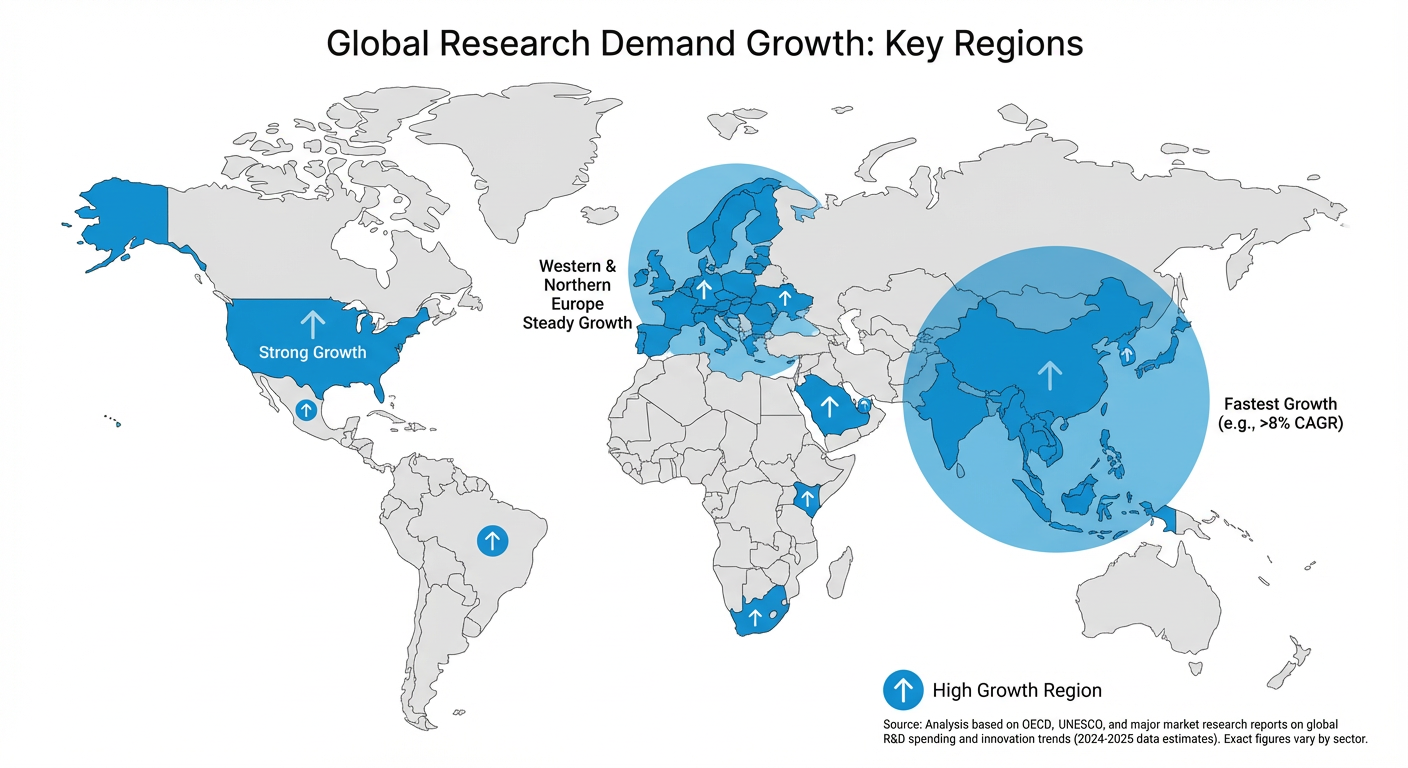

As brands expand globally and especially in fast-growing regions such as Asia, demand for research that spans multiple languages and markets will rise. Research providers will need robust infrastructure: regionally compliant panels, multilingual operations, and the flexibility to deliver across geographies.

Compliance, Transparency, and Ethics Gain Competitive Value

Post-2025, regulatory and ethical concerns are not afterthoughts but central to vendor selection. Clients, especially in regulated industries like healthcare, finance or technology will demand auditable workflows, transparent sampling & consent procedures, and strong data governance. Vendors who take compliance seriously will earn trust and long-term partnerships.

A Glimpse at Youli’s Roadmap for 2026

As part of its response to these shifts, Youli is preparing a renewed roadmap for 2026:

• Investing in AI-enhanced quality control: combining algorithmic detection with human review to flag and filter poor-quality or suspicious responses.

• Prioritizing faster, clearer deliverables: moving beyond raw data to provide summarized insights, actionable takeaways, and easier-to-digest reports.

• Expanding multi-market panel coverage, especially across Asia-Pacific and emerging markets, to support global clients with localized needs.

• Strengthening compliance and transparency: continue improving audit-ready workflows and building processes designed for regulated industries.

• Optimizing for modular, mobile-first, short-form survey formats: fitting how modern respondents actually behave, while responding quickly to client needs.

In essence, Youli is evolving from “panel provider” to “insights partner," focusing on quality, agility, and compliance.

Conclusion

The fundamentals of good research haven’t changed. Data must be reliable, samples representative, analysis meaningful. But what qualifies as “good” is shifting rapidly.

AI, global reach, modular design, compliance, and community-based panels are not just trends. They’re becoming the baseline. Research providers who don’t adapt risk being left behind. Those who do will find themselves at the forefront of a new era of insights: faster, smarter, and more trusted than ever.

Let 2026 be the year we raise the bar, for data, for methodology, and for trust.

_1769067678558.jpg)